Kenya to Borrow Sh 923 Billion for Budget deficit

Kenya will borrow Sh923 billion more for its Sh4.29 trillion 2025/26 budget, a move likely to worsen debt burden.

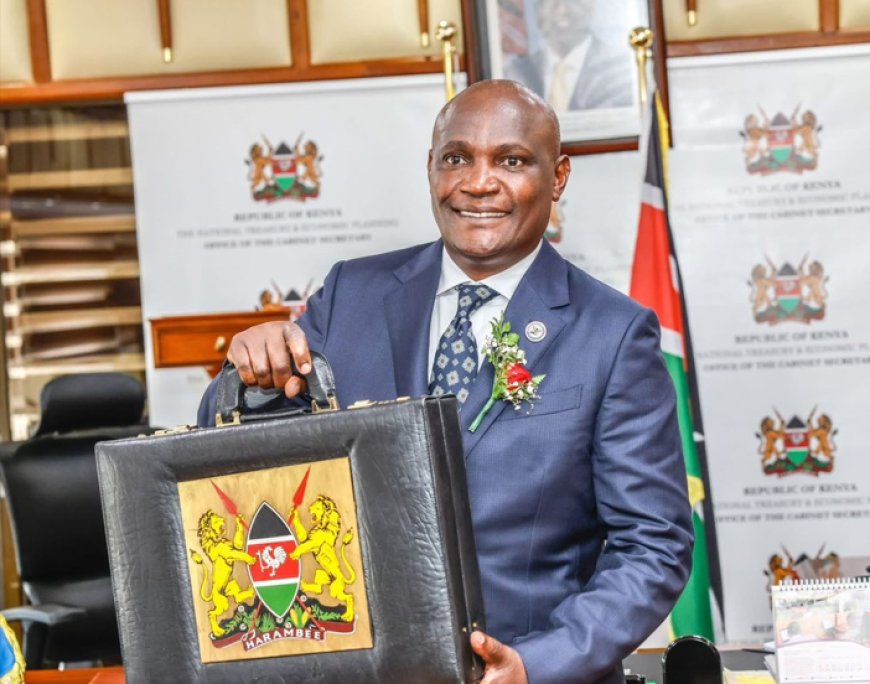

Treasury Cabinet Secretary John Mbadi, while unveiling the budget before the National Assembly, acknowledged the enduring challenge of public debt.

The proposed borrowing is intended to finance a budget that has seen a 10 percent increase from the revised Sh 3.9 trillion estimates for the current fiscal year (FY2024/2025).

Kenya's public debt has been a growing concern, with projections exceeding 60 percent of GDP.

By March 2025, the national debt had hit a record Sh 11.36 trillion.

Debt servicing obligations are substantial, with an estimated Sh 1.37 trillion projected to be consumed in FY2025/2026, an 11percent increase from the previous year.

This substantial allocation to debt repayment often overshadows development spending, raising questions about fiscal sustainability.

The Sh 4.29 trillion budget is primarily structured around recurrent expenditure (Sh 1.79 trillion), Consolidated Fund Services (Sh 1.337 trillion), and development expenditure (Sh 707.8 billion).

Key sectors receiving significant allocations include education (Sh701.1 billion), Energy, Infrastructure, and ICT (Sh 500.7 billion), National Security (Sh 251 billion), and Health (Sh 136.8 billion).

To finance the Sh 923.2 billion deficit, the government plans to diversify its borrowing sources.

Treasury CS Mbadi indicated a reliance on concessional loans from multilateral and bilateral partners, along with limited commercial sources like international bond issuances.

The government intends to explore emerging funding instruments such as debt swaps, diaspora bonds, sustainability-linked bonds, and Environmental, Social, and Governance (ESG) debt instruments.

The government also aims to reduce the fiscal deficit from five point three percent of GDP in FY2023/24 to two point seven percent of GDP by FY2028/29.

The government seeks to manage and reduce the overall debt profile, experts highlight the potential impact of continued borrowing.

Excessive domestic borrowing, in particular, can crowd out private investment by making credit more expensive and less available, potentially stifling economic growth

The significant portion of the budget dedicated to debt servicing also limits funds available for crucial social services and development projects.

Despite these challenges, the government remains optimistic, projecting a five point three percent, GDP growth for 2025 and 2026, driven by improved performance in agriculture, tourism, construction, and ICT.

The 2025/2026 budget is deeply anchored in President William Ruto's Bottom-Up Economic Transformation Agenda (BETA), aiming for inclusive growth and improved livelihoods.

The reliance on significant borrowing underscores the tightrope the government must walk between financing its ambitious development agenda and ensuring long-term fiscal sustainability.

Kenyans will be keenly watching how the government navigates this delicate balance in the coming financial year.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0