KENYA's Sh 4.2 TRILLION BUDGET

The Treasury aims to fund this hefty budget through a multi-pronged approach, drawing from ordinary revenue, grants, fees charged for government services, and a significant reliance on both domestic and external borrowing.

As the clock ticks down to the highly anticipated budget presentation to Parliament, the National Treasury is poised to unveil a colossal Sh 4.2 trillion spending plan for the 2025/26 financial year.

This ambitious budget, the largest in Kenya's history, reflects the government's continued commitment to its development agenda, also highlights the formidable challenge of financing such an expansive expenditure in a fiscally constrained environment.

The Treasury aims to fund this hefty budget through a multi-pronged approach, drawing from ordinary revenue, grants, fees charged for government services, and a significant reliance on both domestic and external borrowing.

However, just hours before the formal unveiling, scrutiny is mounting over the realism of the revenue targets and the implications of increased borrowing.

The projected Sh 4.2 trillion budget represents an approximate six percent increase from the revises Sh4.0 trillion budget for the 2024/25 fiscal year.

To meet this, the Treasury has set an ambitious target of Sh 3.3 trillion in total revenue, comprising Sh 2.7 trillion from tax collection and Sh 560 billion from Appropriations-in-Aid (fees and levies from government services).

Experts are sounding a cautionary note, citing the government's historical struggles to meet revenue targets.

While the administration emphasizes expanding the tax base, particularly into the informal sector, and enhancing tax compliance through initiatives like the e-TIMS system, sustained underperformance remains a key concern.

With grants projected at Sh 46.9 billion, a substantial budget deficit of approximately Sh 876 billion remains. This gap is slated to be financed through borrowing, with a significant shift towards domestic sources.

The Treasury plans to borrow over two-thirds of this deficit, roughly Sh 592 billion, from the local market, with the remaining Sh 284 billion from external sources.

This increased appetite for domestic borrowing has raised eyebrows among economic observers, who warn of its potential to "crowd out" the private sector from accessing credit, thereby impacting business growth and investment.

While the government aims for fiscal consolidation and a reduction in the overall borrowing requirement compared to the previous fiscal year, the heavy reliance on domestic debt presents its own set of challenges.

The 2025/26 budget is expected to bring about behavioral shifts, with a focus on promoting eco-friendly production and boosting local manufacturing through various levies and incentives.

Changes to the Pay-As-You-Earn (PAYE) tax structure are also anticipated, which will have a direct impact on household affordability.

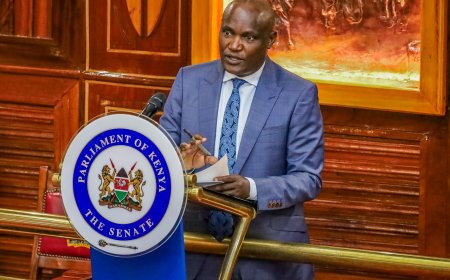

As Treasury Cabinet Secretary John Mbadi prepares to present the detailed budget to Parliament, all eyes will be on how the government plans to reconcile its ambitious spending plans with the realities of revenue collection and debt sustainability.

The success of this budget will hinge not only on its pronouncements but also on the effective implementation of revenue-raising measures and prudent fiscal management to navigate the delicate balance between development aspirations and economic stability.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0